The Billion-Dollar Question: A Financial Deep Dive into the Forrestal Retrofit

By Robert Kroon

The Forrestal Building is set in a prime location close to the National Mall.

A bold vision for architecture and technology is one thing, but for sophisticated investors, it all comes down to one question: Does the math work?

In this supplementary deep dive into our 4-part series on the Forrestal Building, we move from vision to valuation.

We’ll pull back the curtain on the high-level financial model that underpins this entire project, exploring the costs, the potential returns, and the strategic decisions required to turn this federal relic into a highly profitable asset.

A necessary disclaimer: The following is a high-level analysis based on industry standards and reasoned assumptions. It is for illustrative purposes only and is not a substitute for professional due diligence and market-specific financial modeling.

What Do Investors Expect? Defining a Successful Return

A project of this scale and complexity is an "opportunistic" real estate investment. It carries significant risk, and a project of this scale and complexity is considered an "opportunistic" real estate investment.

It carries significant risks, so it must also promise substantial rewards. An investor taking on this project should aim for a high Internal Rate of Return (IRR) of 15-20% or more over a 5-7 year holding period. This benchmark is the target we need to achieve.

Navigating a Shifting Financial Landscape: The Loss of 179D

A crucial factor in any real estate pro forma is the availability of tax incentives. Recently, a significant development for developers occurred when the 179D Commercial Buildings Energy-Efficiency Tax Deduction was eliminated by a bill signed into law by President Donald Trump.

This change directly impacts the bottom line. For the Forrestal project, it removes a potential tax deduction of $10.3 million, resulting in a lost cash value of approximately $2.7 million. Although this may not be a deal-breaker for a project of this scale, the loss must still be considered. It creates downward pressure on how much a buyer can afford to pay for the property and necessitates a more disciplined review of the budget.

Building the Budget: The Cost Side of the Equation

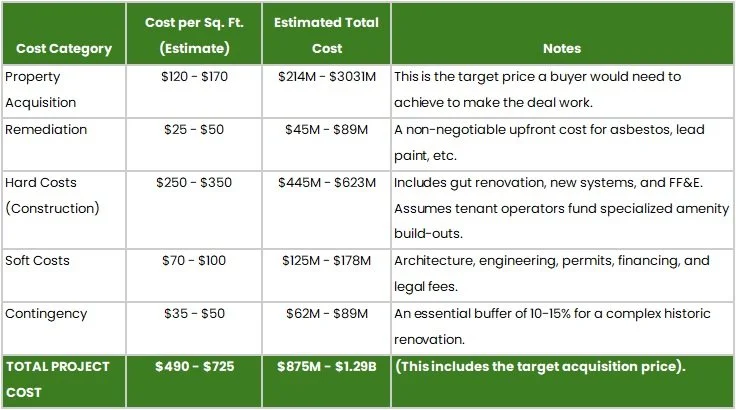

To understand the potential profit, we first have to understand the all-in cost. Our high-level budget assumes the building owner provides the core and shell, common areas, and the agile-ready workstations, while tenant operators for the daycare and ghost kitchen fund their own specialized interior construction.

Here’s a look at the major cost centers for the 1.78 million sq. ft. property:

Major Project Costs

The Path to Profitability: Calculating the Exit Value

With a potential all-in cost approaching or exceeding $1 Billion, how does an investor hit a 15-20% return? We do it by working backward from the building's future value after it’s fully renovated and leased up.

Step 1: Project the Income. The building's income, or Net Operating Income (NOI), is its total revenue minus operating expenses. Based on our vision of a premium, hyper-efficient building, we project a stabilized NOI of roughly $76.6 million per year. This comes from a combination of leasing 8,000 seats at premium rates and generating new revenue from the on-site microgrid.

Step 2: Determine the Future Value. An office building's value is determined much like any other financial asset: by the size and quality of the income it produces. In real estate, this is calculated with a "Capitalization Rate" or "Cap Rate." A lower cap rate implies a higher quality, lower risk asset.

Future Stabilized Value = Net Operating Income / Cap Rate

Given that this building will be a best-in-class, highly resilient, and ESG-friendly trophy asset, we can assume it will command a premium (i.e., lower) cap rate of 4.25% - 4.75%.

$76.6M / 0.0475 (4.75% Cap Rate) = $1.61 Billion

$76.6M / 0.0425 (4.25% Cap Rate) = $1.80 Billion

The Final Verdict: A Vision Backed by Value

An August Berres Respond! Desk: battery-powered, mobile, no wired connections required.

The model is clear: by investing approximately $1.1 Billion (midpoint estimate), an investor can create an asset worth $1.7 Billion (midpoint estimate) within a few years.

This demonstrates that our vision is not just a dream. It is a financially sound business plan that respects the building's history while unlocking its future potential. By focusing on a superior Tenant Experience and best-in-class technology, we don't just create a great place to work; we engineer a highly profitable investment. With a disciplined acquisition and flawless execution, the Forrestal Building retrofit represents one of the most exciting real estate opportunities in the country.