The $2.4 Million Value Proposition: Why Agile Workplaces Are the New ROI Engine for Suburban Office Retrofits

By Robert Kroon

In the current commercial real estate landscape, traditional Class B/C suburban office assets are under immense financial pressure. However, forward-thinking investors are recognizing a massive, overlooked opportunity: transforming these obsolete properties into high-demand Agile Workplaces.

A retrofit of an older building can deliver a high ROI when designed as an Agile Workplace.

The key to unlocking this value is a targeted investment strategy that bypasses the crippling costs of conventional electrical retrofits by deploying flexible, battery-powered infrastructure. This strategy delivers a highly profitable, valuable, and tenant-friendly asset.

What is the difference between a traditional workplace and an Agile Workplace?

Part 1: The Strategic Opportunity: Targeting High-Confidence Value

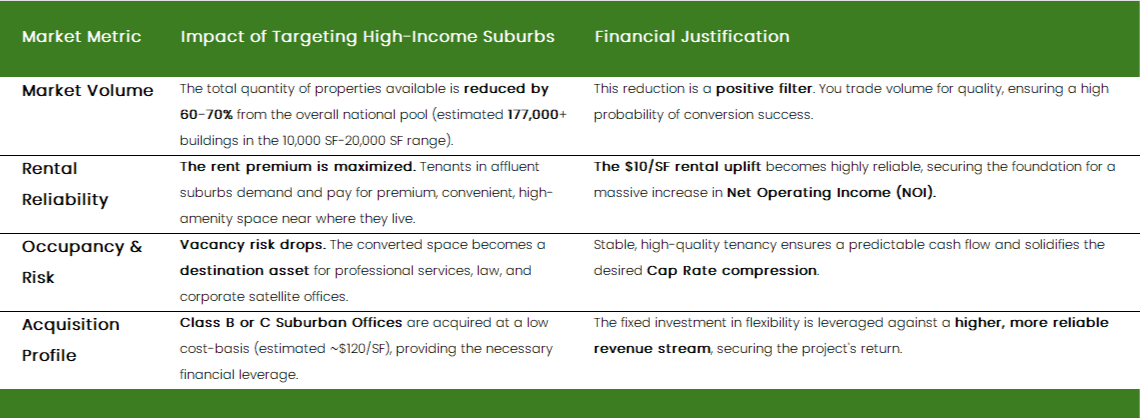

The strategic move is to trade sheer volume for reliable return. By focusing on high-income suburban corridors, the investment is placed where the rental premium is most justifiable and tenancy is most stable.

The Sweet Spot Market Scale: Quality Over Quantity

The 10,000 to 16,000 SF floorplate is the structural sweet spot because it captures the majority of the existing, aging Class B/C inventory (e.g., pre-1960 buildings average 13,300 SF).

Filtering this market by high-income suburbs changes the strategy:

Exemplary Acquisition Targets (High-Income Suburbs)

These are examples of buildings currently for sale that illustrate the typical acquisition that is ripe for transformation into an Agile Workplace:

Part 2: The Core Financial Strategy: Leverage and Value Creation

The financial model demonstrates that targeted capital expenditures focused on flexibility yield superior returns compared to conventional renovations.

Total Project Investment Estimate (Example: 12,000 SF)

The model is based on a 12,000 SF floorplate that can efficiently accommodate approximately 120 people.

ROI Drivers: Cash Flow and Appreciation

The ROI is driven by capturing the high-end rent market while simultaneously eliminating the biggest operational expense.

Part 3: The Technology and Tax Strategy that Secures Profit

The financial success of this model is entirely reliant on the strategic deployment of flexible power and the use of smart accounting to maximize immediate cash flow.

Cost Segregation: The Immediate Cash Flow Advantage

For a capital-intensive retrofit, Cost Segregation is a non-negotiable component that magnifies the after-tax ROI. By reclassifying building components from long (39-year) depreciation lives to short (5- or 7-year) lives, investors realize massive deductions sooner.

Accelerated Tax Shield: A significant portion of the $2,040,000 in retrofit CapEx—including specialized electrical installations for technologies such as fault-managed power (FMP) and battery-powered Agile Furniture, along with movable partitions and your investment in Agile Furniture—is eligible for this accelerated depreciation.

Lower Effective Acquisition Cost: The tax savings generated in the first year directly offset the initial cash outlay, effectively lowering the cost of acquiring the distressed Class B/C property and dramatically increasing the Cash-on-Cash Return.

Bypassing the Electrical Roadblock

Conclusion: Quantifying the Financial Return

By combining a strategic acquisition in a high-demand suburban corridor with a tax-efficient, flexible retrofit, you achieve a proven formula for success. The ∼120% Return on Renovation Capital confirms that the investment in the Agile Workplace is not an expense, but a high-leverage capital strategy that transforms a struggling asset into a market leader.

August Berres Agile Workplace products, such as these Respond! desks, enable a high ROI.

Learn more about Agile Workplace design

Contact us now!

About the author:

Bob Kroon is a recognized thought leader and innovator with over four decades of experience in the electro-mechanical and furniture industries. As the CEO and founder of August Berres, he envisions overcoming the limitations of traditional building power by enabling the Agile Workplace through a smart power ecosystem.

-

Bob passionately advocates for technologies such as building microgrids, fault-managed power (FMP), and battery-powered Agile Furniture, which are transforming the design and utilization of commercial spaces. Under his leadership, a suite of innovative solutions has been brought to market, including Respond!, Juce, CampFire, and Wallies. These products empower building owners, architects, and facility managers to retrofit buildings for today’s dynamic work environment.