Unlocking Hidden Value: A Strategic Guide to Middle-Market Office Retrofits

By Robert Kroon

Executive Summary: The Untapped Potential of Non-Trophy Assets

This report posits that the conventional wisdom favoring iconic structures or premier locations for office retrofits overlooks a significant and increasingly lucrative opportunity: the middle-market building segment. Far from being marginal, non-trophy office buildings (Class A, B, and C) represent a vast, often undervalued, asset class ripe for strategic transformation.

Through detailed economic justification, compelling case studies, and a pragmatic roadmap for budget-conscious implementation, this analysis demonstrates that retrofitting these assets yields substantial returns, enhances market competitiveness, ensures regulatory compliance, and contributes meaningfully to sustainability goals. The report provides actionable insights for property owners and investors to unlock hidden value, navigate complexities, and secure a resilient future for their middle-market portfolios.

The post-pandemic market has created a distinct bifurcation, where top-tier trophy assets command exorbitant premiums while Class A, B, and C buildings, particularly in the middle-market segment, offer significant concessions.1 This dynamic presents a unique window for value creation through strategic retrofits in non-trophy buildings.

While trophy properties may boast higher face rents, the substantial tenant improvement allowances and months of free rent offered in non-trophy Class A and B buildings can effectively narrow, or even eliminate, the perceived cost advantage of premier locations.1 This means that a well-executed retrofit on a non-trophy building can achieve a competitive tenant experience at a significantly lower effective cost base for the tenant, thereby increasing its market attractiveness and potentially its net operating income.

This directly challenges the premise that iconic structures are the only viable starting point for impactful office retrofits.

The Evolving Landscape of Office Real Estate: Redefining Value Beyond the Iconic

The post-pandemic era has fundamentally reshaped office demand, creating a bifurcated market where value is increasingly defined by functionality, sustainability, and tenant experience, rather than solely by prime location or architectural grandeur. This section dissects the middle-market segment and challenges the traditional hierarchy, presenting a compelling argument for the strategic viability of non-trophy retrofits.

Deconstructing "Middle Market" and "Non-Trophy" Office Buildings

Understanding the nuances of office building classifications is paramount to identifying retrofit opportunities. The "non-trophy" category is not monolithic but comprises a spectrum of assets with distinct characteristics and market positions.

For commercial real estate, "mid-market" refers to office buildings, retail spaces, or industrial properties that, while not in prime locations, still offer good quality and investment potential.2 These properties are accessible to a broader range of investors and homebuyers than luxury properties, providing a balance between affordability and desirable features.3 This segment is crucial for serving a significant portion of the market, offering opportunities for growth and investment.3

The definition of "mid-market" is fluid, varying significantly depending on the geographical location and local market conditions. This inherent variability underscores that a successful retrofit strategy must be highly localized and responsive to specific market demands, rather than a one-size-fits-all approach. A building's investment potential is often determined by its intrinsic quality and its ability to meet evolving tenant needs, irrespective of its "prime" location. [^1]

The "non-trophy" office segment is further categorized into Class A, Class B, and Class C buildings, each presenting unique characteristics and retrofit potentials:

Class A Office Buildings (Non-Trophy Segment): These are typically the second tier of spaces, actively competing for premier office tenants. They are often situated in central locations and possess top-notch characteristics, frequently being well-capitalized or institutionally owned. While they may not boast the complete profile and total package of trophy buildings, they consistently offer enhanced tenant experiences.4

Class A buildings might be slightly more dated or lack the most up-to-date infrastructure, amenities, or the unique "cache" associated with trophy assets. Nevertheless, they typically feature high-end finishes and are usually located in premier neighborhoods.5 The fact that Class A buildings are already vying for premier tenants suggests that a repositioning strategy for these assets can focus on refining the tenant experience and enhancing amenities to capture a larger share of the high-quality tenant market.

Class B Office Buildings: These properties present a compelling balance between affordability and quality, making them an attractive choice for a diverse range of tenants.6 While typically older than Class A properties, they are characterized by solid construction quality and functional spaces, often commanding average rental rates.6

Class B buildings are commonly found in secondary business districts or on the outskirts of financial hubs, providing comfortable working environments with established tenant histories.6 They are generally nice, fully-functional buildings but may not boast the same high-end fixtures, striking lobbies, or cutting-edge architecture as their Class A counterparts.

Maintenance and upkeep are typically solid, and their HVAC and elevator systems are functional, though not necessarily top-of-the-line. Their technological capacity is generally adequate.7 Tenants in Class B spaces often prioritize function over form, including companies in sectors like IT, creative services, call centers, and smaller professional services that cater to a less flashy clientele.7 Common amenities found in Class B buildings include on-site parking, security, conference rooms, bike storage, cafeteria-style or café dining, and shared outdoor space.7

For investors, Class B offices are often considered "the best of both worlds" due offering affordable locations and minimalist amenities that make it easy to find affordable investment deals, while simultaneously appealing to a broad range of prospective tenants.6 This balance positions Class B buildings as a sweet spot for value-add strategies through targeted upgrades that improve functionality and appeal to a diverse tenant base.

Class C Office Buildings: These represent the oldest and generally least desirable of the office building classes, frequently requiring significant upgrades or renovations to meet modern standards.5 They typically offer only basic amenities and have the lowest rental rates, commonly found in less visited or remote areas, or as recently bank-owned commercial properties.6

Class C buildings may lack modern conveniences such as elevators or central air conditioning, and their older infrastructure often necessitates frequent maintenance and updates.6 These properties are often viewed as "fixer-uppers" for investors whose primary goal is to upgrade them to Class B status.7

Tenants in Class C properties are typically budget-conscious small businesses, often industrial or service-oriented, with blue-collar workers, such as companies involved in engineering, landscaping, sign making, security, construction, plumbing, or electrical services.6 Amenities are basic, usually limited to onsite parking and break rooms.7

The detailed classification of office buildings reveals that the "non-trophy" market is not a homogeneous entity but a nuanced landscape. A successful retrofit strategy must be highly granular, tailored to the specific class, existing condition, and target tenant profile of the building. This indicates that the case for retrofitting "non-trophy" buildings is not a singular argument but rather a collection of distinct approaches, each tailored for its specific category, providing different risk-reward profiles and avenues for value creation.

The distinctions between Class A, B, and C are not rigid, with classifications varying by local markets and opinions.5 This fluidity implies that a Class B building in one market might be perceived as a Class A- in another, underscoring the critical importance of localized market analysis to accurately assess retrofit potential.

The Shifting Paradigm: Why Non-Trophy Buildings are Prime for Retrofit

The market is increasingly recognizing the inherent value and strategic advantages of investing in well-executed retrofits of middle-market assets, often at a more competitive price point than new construction or trophy premiums.

Historically, demand for trophy office buildings has often led the market out of economic downturns. However, with the maturity of the economic recovery, a notable trend has emerged: an increase in companies leasing and renewing large blocks of Class A space.4 In specific markets, such as Chicago's North and Northwest Suburban office sectors, Class A office activity has begun to outpace Trophy absorption.

Premier tenants are increasingly drawn to well-capitalized Class A buildings that provide new and unique tenant environments, similar to what Trophy buildings have offered for years, but at a more competitive price point.4 This shift suggests a fundamental change in tenant priorities, moving beyond pure prestige to a blend of quality, amenities, and pricing. A non-trophy building, through a thoughtful retrofit, can deliver these desired elements without the exorbitant "trophy fever" premium, making it a more attractive option for a broader range of tenants.

While trophy office buildings command significantly higher face rents, with branded properties pulling in 55-85% rent premiums, ranging from $135 to $322 per square foot (psf) compared to the Midtown Class A average of $82 psf.1 For a 10,000 square foot space, this can translate to an additional $2.4 million annually just for the prestige of a famous name on business cards.1 Trophy buildings also generally boast lower vacancy rates, with branded properties maintaining a 12% vacancy compared to an overall Class A vacancy rate of 22%.1

However, the perceived superiority of trophy buildings in terms of effective rent is often mitigated by substantial tenant concessions offered in non-trophy Class A buildings. These concessions have been generous, averaging 24% of total rent since 2020 (an increase from 17% pre-pandemic).1 Such incentives can include up to 16-17 months of free rent on 10-year leases and tenant improvement (TI) allowances peaking at $145-$170 psf.1 Non-trophy Class A buildings, for instance, average $132.57 psf in TI allowances plus 11-12 months of free rent.1

Significant concessions can reduce the effective rent gap, making the net cost of leasing in older, less prestigious buildings comparable to, or even lower than, trophy towers.1 This dynamic creates an arbitrage opportunity for investors in middle-market buildings: by investing in strategic retrofits, they can offer a highly competitive product at an attractive, effective price point, capturing demand from tenants who prioritize value and functionality over a prestigious address.

The drive for sustainability has also become a core value proposition in the real estate market. The built environment is responsible for a substantial 40% of all carbon emissions.8 Retrofitting existing buildings offers a critical opportunity for emission reduction and energy conservation.9 By reusing the original structure, retrofits significantly reduce embodied carbon compared to new construction, which involves demolition and reconstruction.8

This environmental benefit is not merely an ideal but a market necessity. Green building retrofits deliver "proven results with minimal cost" and have successfully raised the profile of building sustainability in the public consciousness, even if they may not generate the "catchy headlines" common amongst trophy construction projects.10 This positions retrofits as a future-proof investment strategy, aligning with increasing Environmental, Social, and Governance (ESG) goals of corporations and investors.11

The increasing focus on sustainability is transitioning from a "nice-to-have" amenity to a fundamental requirement for market relevance and long-term asset value. Middle-market buildings, often older and less efficient, have the greatest potential for significant environmental impact reduction through retrofits, positioning them as leaders in the decarbonization of the built environment and securing their future marketability.

The Irrefutable Economic Justification for Middle-Market Retrofits

The economic case for retrofitting middle-market office buildings is robust, driven by a confluence of regulatory pressures, operational cost savings, and enhanced tenant appeal. This section quantifies these benefits and outlines strategies for maximizing financial returns.

Drivers of Investment: Necessity Meets Opportunity

Retrofitting is firmly establishing itself as a strategic imperative, turning older assets from potential liabilities into valuable, competitive properties.

New regulations serve as a powerful catalyst for investment in retrofits. For instance, Minimum Energy Efficiency Standards (MEES) regulations are specific to England and Wales and came into force in 2018. They require commercial properties to have a minimum Energy Performance Certificate (EPC) rating of 'E' to be legally let, with the standard rising to 'C' by 2027 and 'B' by 2030. Buildings failing to meet these standards risk falling "foul" of regulations, potentially leading to restrictions on leasing or even penalties.

This regulatory pressure transforms retrofitting from a discretionary investment into a necessity for continued market participation and value preservation. The MEES regulations represent a ticking clock for property owners, particularly for older, less efficient middle-market buildings that are most likely to fall below these thresholds. Non-compliance means the asset risks becoming commercially obsolete or incurring penalties, directly impacting its value. Therefore, retrofitting is not just about improving value but about preventing value erosion and ensuring future market viability, making it a powerful, non-negotiable economic driver for middle-market assets.

While MEES is specific to England and Wales, other jurisdictions have implemented their distinct energy efficiency standards and regulations. For example, the U.S. Department of Energy (DOE) sets minimum efficiency requirements for residential and commercial HVAC equipment that vary by climate region. New York City's Local Law 97 sets emissions limits for buildings over 25,000 square feet, and California's Title 24 Energy Efficiency Standards play a crucial role in retrofitting older buildings within that state. These examples demonstrate that the regulatory push for energy efficiency is a global phenomenon.

Retrofitting also leads to substantial reductions in operational costs. By integrating energy-efficient technologies, such as low-energy LED lighting and smarter heating and cooling systems, property owners can achieve significant energy savings. Energy consumption in buildings, primarily for heating, cooling, ventilation, and lighting, accounts for 28% of global CO2 emissions.

By upgrading these systems, owners can significantly lower energy bills and reduce maintenance costs. These energy cost savings provide a direct and immediate boost to Net Operating Income (NOI). The availability of "low-to-no-cost measures" suggests that even modest investments can yield significant returns, making retrofits accessible even for budget-constrained owners.

Beyond direct cost savings, retrofits enhance tenant attraction and retention. As businesses increasingly shift their focus back to the office, the importance of meeting MEES requirements, reducing operational costs, and attracting modern tenants means office space is increasingly being upgraded for sustainability and relevance. Retrofitting enhances office space, making "Work From Office" (WFO) more attractive to employees by improving comfort and functionality.

There is also evidence that amenities and higher sustainability credentials can increase lease lengths, reduce void periods, and lead to compressed yields. These "soft benefits" translate into tangible financial gains by reducing vacancy risk and strengthening tenant relationships in a competitive market where tenant experience is paramount.

The drivers for retrofit are not isolated but interconnected. Regulatory compliance compels investment, which, when executed strategically, leads to reduced operational costs. Simultaneously, the improved energy efficiency, comfort, and modern amenities attract and retain tenants, leading to longer leases and lower vacancy. The environmental benefit of reduced embodied carbon further enhances the asset's appeal in an increasingly ESG-conscious market.

This creates a virtuous cycle where compliance drives investment, which in turn drives financial and market performance. Retrofitting is no longer merely a maintenance expense but a multi-faceted strategic investment that addresses regulatory risk, enhances profitability, and secures market relevance in a rapidly evolving real estate landscape. For middle-market buildings, this transforms a potential liability (age, inefficiency) into a significant competitive advantage.

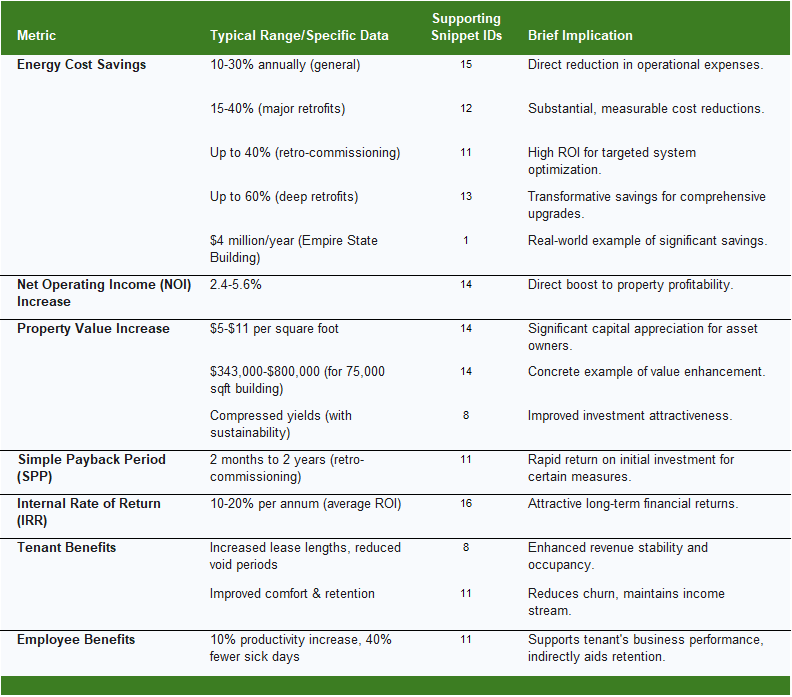

Quantifying the Return: A Deep Dive into ROI Metrics

The financial benefits of retrofitting middle-market office buildings are substantial and quantifiable across multiple key performance indicators.

Retrofits can lead to significant energy consumption reductions and corresponding cost savings. Energy-efficient retrofits can save property owners between 10% and 30% on energy costs annually.15 Major energy retrofits typically yield 15% to 40% energy savings.12 Retro-commissioning alone has been shown to achieve up to 40% energy savings, which is seven times more than a typical single-measure retrofit.11 For extensive transformations, deep retrofits, involving comprehensive overhauls of building systems, can save up to 60% in energy costs.13 A notable example is the Empire State Building's deep retrofit, which cut energy use by 38%, resulting in approximately $4 million in annual utility savings.1

These energy savings directly translate into improved financial performance. For Class B/C properties, saving roughly 15% of their energy costs with low-to-no-cost measures, or 35% or more with larger investments 14, can lead to net operating income increases of 2.4% to 5.6%.14 Concurrently, property value can increase by $5 to $11 per square foot, which for a 75,000 square foot building, translates to an increase of $343,000 to $800,000.14 Furthermore, higher amenity levels and sustainability credentials have been shown to increase lease lengths, reduce void periods, and lead to compressed yields.8

Project feasibility is rigorously assessed using several key financial indicators:

Simple Payback Period (SPP): This metric indicates the time it takes for the savings generated by a retrofit to recoup the initial investment.9 Studies demonstrate that retro-commissioning, for instance, can have remarkably short payback periods, ranging from as little as two months to two years.11

Internal Rate of Return (IRR): The IRR represents the discount rate at which the net present value (NPV) of all cash flows from a project equals zero.9 Average ROIs for retrofit and upgrade projects typically range from 10% to 20% per annum.16

Net Present Value (NPV): The NPV is the present value of the expected future cash flows from the retrofit, discounted at a specific rate.9 A positive NPV indicates a financially viable project that is expected to generate more value than its cost.

Beyond direct financial metrics, retrofits offer significant "soft benefits" that contribute to long-term value. These include increased property values 11, improved tenant comfort and retention 11, longer equipment life, and reduced maintenance costs.11 Furthermore, studies suggest a potential for a 10% improvement in employee productivity and 40% fewer employee sick days due to improved indoor environmental quality.11 Retrofits also enhance public recognition and accountability regarding Environmental, Social, and Governance (ESG) goals.11

The benefits of retrofit investments are not linear but often compound. Initial energy savings directly boost NOI and property value. These financial gains can then enable further investments or improve the asset's attractiveness for financing. Moreover, improved tenant comfort and retention translate into reduced void periods and increased lease lengths, which directly impact the property's income stream and valuation.

The reduction in CO2 emissions also enhances ESG credentials, appealing to a broader investor and tenant base. A holistic view of retrofit ROI must account for these interconnected benefits. Focusing solely on a short-term payback for a single measure, a common pitfall in financial analysis, misses the compounding returns and the overall increase in asset value.

The true value of a retrofit lies in its ability to simultaneously enhance financial performance, operational efficiency, tenant satisfaction, and environmental stewardship, creating a resilient and highly marketable asset. For middle-market buildings, this transforms a potential liability (age, inefficiency) into a significant competitive advantage.

Table 1: Economic Justification: Key ROI Metrics for Middle-Market Office Retrofits

Navigating Costs and Maximizing Financial Levers

A thorough understanding of costs and available financial levers is essential for successful middle-market retrofits.

Initial investment costs for retrofits typically include materials and supplies (e.g., energy-efficient appliances, insulation, windows), labor costs (e.g., contractors, electricians, plumbers), equipment costs (e.g., HVAC systems, solar panels), permitting and inspection fees, and design and engineering costs.15 It is important to note that the costs relating to office retrofits can vary significantly.8 Beyond the initial outlay, ongoing costs include regular maintenance tasks (e.g., filter replacements, duct cleaning) and repair and replacement costs for retrofitted systems and equipment.15

Crucially, the costs associated with not retrofitting a rental property can be substantial and often overlooked. These include energy inefficiency and increased utility costs, reduced property value and rental income, decreased tenant satisfaction and retention, and potential costs associated with repairing or replacing outdated systems and equipment.15 As regulations tighten and tenant demands evolve, failing to retrofit can lead to asset obsolescence and significant financial penalties. This frames retrofitting as a defensive strategy to prevent value depreciation, in addition to an offensive one for value creation. This nuanced understanding is crucial for a comprehensive economic justification.

To mitigate initial capital expenditure and enhance project feasibility, property owners can leverage various financial levers:

Utility Incentives: Many utilities offer performance-based retro-commissioning incentives, which can significantly accelerate payback periods and sometimes even cover the entire project. For example, California's Pacific Gas and Electric (PGE) pays owners $0.09 for every kilowatt-hour (kWh) saved, with payments based on estimated and actual savings. The Los Angeles Department of Water and Power (LADWP) breaks down retro-commissioning incentives by retrofit category, with non-lighting incentives capped at 75% of the total cost and lighting incentives potentially covering 100%.11 Similar programs are offered throughout the country.11

Government Grants and Loans: Green grants, bonds, and low-interest finance are increasingly emerging as options to support sustainable retrofits.16

Energy Efficiency Loans: Specific loans are available that are designed to fund energy-efficient upgrades, often with favorable terms due to the projected energy savings.16

Energy Service Company (ESCO) Partnerships: ESCOs offer turnkey solutions that include financing, installation, and maintenance of retrofit and upgrade projects.16 This can be an attractive option for building owners and managers who may lack the in-house expertise or resources to implement such projects themselves.16

The existence of these various incentives and financing options directly addresses the barrier of initial cost. This demonstrates that capital expenditure, while a critical factor, is not an insurmountable hurdle, especially for well-planned projects that strategically integrate these financial levers.

Valuation and Risk in Retrofit Transactions

The estimated cost of a retrofit and the associated risks should significantly influence the price a buyer is willing to pay for a commercial property. Buyers engage in thorough due diligence to minimize risks, verify property details, assess its condition, and uncover any potential issues or liabilities before finalizing a purchase.20

Influence on Buyer Price: Buildings that have undergone deep energy retrofitting are demonstrably more attractive to potential buyers, who are willing to pay a premium of 13.5% over properties in pre-retrofit conditions.21 This highlights that the value added by a retrofit, in terms of improved energy efficiency and enhanced market appeal, can directly translate into a higher sale price.

Conversely, a property requiring significant retrofits to meet modern standards or regulatory compliance (e.g., MEES regulations) would likely command a lower initial purchase price to account for the future investment required. Appraisals, conducted by certified professionals, are instrumental in determining the fair market value of a property, considering factors such as location, size, condition, and comparable sales. These assessments inform negotiations and ensure the property is priced appropriately.20

Price Discount for Risk: Yes, there should absolutely be a price discount for risk when acquiring a property that requires retrofitting. Inadequate due diligence can lead to disastrous outcomes, such as overpaying for a property, being ensnared by hidden liabilities, or facing unforeseen operational costs.20 The perceived risk of a retrofit investment, including the transaction costs of conducting due diligence, should be minimized.22 Physical Condition Assessments (PCAs) are crucial in identifying potential deficiencies, safety hazards, and evaluating existing mechanical, electrical, and plumbing systems, along with recommendations for necessary repairs or maintenance.20

The presence of outdated infrastructure, potential asbestos (in buildings built before 2000), and the complexities of integrating new systems with old ones all contribute to project risk and potential cost overruns.14 These risks, if not properly assessed and accounted for, can lead to inaccurate property valuations and misguided pricing decisions.20 Therefore, a buyer should factor in a discount to the purchase price to cover these potential unforeseen expenses and the inherent uncertainties of a retrofit project. Green bonds, for instance, can help aggregate a large number of smaller retrofit projects that might otherwise incur a risk premium due to their individual size.22

Understanding the value that energy retrofitting adds to market prices is critical for encouraging investments and accelerating the adoption of energy-efficient solutions.21 This dual perspective, integrating actual cost analysis with perceived market value and a clear understanding of associated risks, is essential for informed investment decisions in the middle-market segment.

Real-World Success Stories: Case Studies in Middle-Market Transformation

This section will provide concrete examples of successful retrofits in non-trophy and middle-market contexts, illustrating the principles and economic benefits discussed. These case studies highlight diverse approaches, from pure energy efficiency to complete transformation, demonstrating the versatility and value-unlocking potential of retrofitting.

Energy Efficiency as a Value Driver: The Self-Help Building Experience

The Self-Help office building in downtown Wilmington N.C., constructed in 1906, serves as a compelling example that age is not a barrier to achieving significant energy efficiency gains.25 This building, shown on the right, likely designed without efficiency in mind, underwent strategic retrofits to improve its energy performance and make it more affordable for its retail, small business, and non-profit tenants.25

The specific upgrades implemented included the installation of a building management system (BMS) and a new chiller.25 These targeted interventions yielded impressive financial results: a 21% reduction in energy costs and a 13% reduction in water costs.25 The site's energy use intensity (EUI) was lowered by 28%.25 Annually, these upgrades resulted in energy savings of $11,100, transforming the property into a more productive asset and potentially leading to a lower capitalization rate and increased property value.25 Another Self-Help office building in Greensboro, NC, similarly utilized operational expense savings from energy efficiency retrofits to preserve affordable rents for 21 non-profit tenants in a mid-rise office building.25

The Self-Help case study directly demonstrates that even very old buildings, clearly not trophy assets, can achieve substantial energy performance improvements and financial returns through focused retrofits. This example is particularly relevant for owners with modest budgets, as it shows that strategic, rather than comprehensive, upgrades can yield significant return on investment.

Repositioning for New Market Demands: The DWS Group's Medical Office Conversion

The DWS Group's renovation of a 1970s-era complex at 50, 60, and 62 Staniford Street in Boston's West End exemplifies how retrofits can be part of a broader strategic repositioning to meet evolving market demands.26 The goal was to transform this general office complex into a first-class medical office building, leveraging its proximity to major medical and research institutions such as Massachusetts General Hospital, Shriner’s Hospitals for Children, and Mass. Eye & Ear.26

The renovation process involved a comprehensive strategy, from navigating construction with existing tenants to securing city approvals and increasing the building's Planned Development Area.26 A key architectural intervention was connecting 50 and 60 Staniford Streets, which expanded the ground and first floors by 20,000 square feet, creating new space specifically designed for medical offices, dry research, and retail tenants.26

Following the renovation, the Staniford complex now features a 10-story medical office tower and a new two-story medical office building, which also provides space for retail tenants.26 This investment by DWS significantly increased the complex's value and improved access to high-quality space ideal for medical office and retail users.26

This case study illustrates a successful transformative retrofit, demonstrating that middle-market buildings can be adapted to serve highly specialized and lucrative market segments. The complexity of navigating construction with existing tenants and securing necessary approvals underscores the importance of expert planning and phased approaches, which are crucial considerations for budget-conscious projects. This project highlights that retrofits can go beyond mere energy savings to completely change an asset's market segment and significantly increase its value, provided there is a clear market demand for the new use.

Lessons from Diverse Middle-Market Projects

The Institute for Market Transformation (IMT) has compiled a series of case studies on "Valuing Energy Efficiency" that underscore the broad applicability of retrofit principles across a diverse range of building types, beyond just office spaces.25 These studies demonstrate that building owners do not require a "billion-dollar budget nor a large floorplate" to achieve significant energy and cost savings through retrofits.25

Examples from this series include:

University of Minnesota (Laboratory Space): The retro-commissioning of the University of Minnesota's Biological Sciences laboratory highlighted the opportunity to invest in energy efficiency within the institutional sector, where optimizing an existing building's energy performance can extend its useful life.25

Tusco Display (Manufacturing Space): This custom fabrication company strategically used energy efficiency in its manufacturing and commercial spaces to lower costs, improve productivity, and gain a cost advantage in a challenging market with many competitors.25

Office Space: Self-Help, Greensboro, NC. Through energy efficiency retrofits, Self-Help uses operational expense savings to help preserve affordable rents for 21 non-profit tenants in a mid-rise office building in Greensboro.25

These diverse case studies collectively reinforce that the underlying principles of energy efficiency, system optimization, and strategic upgrades are transferable and effective across various commercial property types and ages. They demonstrate that significant energy and cost savings are achievable "without requiring a raise in rent or product prices to justify the retrofit expenditure" 25, which is crucial for maintaining affordability and competitiveness in middle-market segments.

The success stories from these varied commercial contexts provide a broader evidence base and transferable lessons for middle-market office retrofits, particularly regarding the return on investment of energy efficiency and smart technologies. Furthermore, smart retrofitting (SR) in office buildings, incorporating advanced technologies like energy-efficient LED lighting with motion and daylight sensors, HVAC optimization, renewable energy systems, smart lifts/escalators, and intelligent automation for security, can significantly reduce energy consumption and operational costs while enhancing occupant comfort and convenience.27

Comparative Analysis: Retrofit Practices in Non-Trophy vs. Trophy Buildings

While both non-trophy and trophy office buildings engage in retrofitting to enhance sustainability and appeal, there are notable distinctions in their approaches, driven by differing motivations, constraints, and market positions.

Common Practices in Non-Trophy Building Retrofits

Based on the case studies and general descriptions of middle-market (Class A, B, and C) office buildings, several common retrofit practices are evident:

Energy Efficiency as a Core Driver: A primary focus is on reducing energy consumption and operational costs. This includes upgrading to energy-efficient LED lighting, optimizing HVAC systems, and improving the building envelope through measures like insulation and air sealing. The Self-Help building, for instance, achieved significant energy and water cost reductions through the installation of a building management system (BMS) and a new chiller.25

System Optimization and Smart Technology Integration: Non-trophy buildings frequently implement smart technologies to enhance performance. This involves integrating modern BMS for real-time monitoring and automated adjustments, installing Variable Frequency Drives (VFDs) for HVAC systems, and utilizing sensors for lighting and climate control. Retro-commissioning existing HVAC systems is also a cost-effective approach to ensure they operate at peak efficiency.10

Phased and Incremental Approaches: Especially for buildings with modest budgets, retrofits are often undertaken in phases, starting with "low-hanging fruit" measures that offer quick returns. This allows for reinvestment of savings into subsequent, larger upgrades.

Cost-Effective Aesthetic and Functional Upgrades: Many non-trophy buildings focus on improvements that enhance tenant comfort and perception without requiring major capital outlays. This can include fresh paint, decluttering, reorganizing and repurposing existing furniture, creating open concepts, and incorporating biophilic design elements like plants.

Water Efficiency Measures: Beyond energy, water conservation is also a common practice, involving monitoring and optimizing cooling tower operations and installing low-flow fixtures.10

Distinctions from Trophy Building Retrofits

While both non-trophy and trophy buildings aim for improved performance and sustainability, key differences emerge in the scale of intervention, regulatory considerations, and primary motivations:

Scale and Depth of Intervention:

Non-Trophy Buildings: Often prioritize incremental improvements and "low-to-no-cost measures" to achieve significant energy and cost savings, making them accessible even with modest budgets.14 The focus is on practical upgrades that deliver a strong return on investment.

Trophy Buildings: While they also undertake initial interventions like LED lighting, there's a greater emphasis on "deeper interventions" and tackling the "root causes of energy inefficiency" within the building's core structure and overall systems.22 For example, the Empire State Building's deep retrofit significantly cut energy use by 38%, resulting in approximately $4 million in annual utility savings.1 This often involves more comprehensive and potentially more disruptive overhauls.

Regulatory and Heritage Considerations:

Non-Trophy Buildings: Primarily focus on meeting general energy efficiency standards (e.g., MEES regulations) and building codes. While compliance is crucial, they generally do not face the same level of heritage-related restrictions.

Trophy Buildings (especially historic ones): Face unique regulatory hurdles due to heritage preservation laws. These can complicate deeper interventions, such as installing onsite renewables or making significant changes to the building's facade or structure, as approvals can be difficult to obtain.22

Motivation and Market Positioning:

Non-Trophy Buildings: Retrofits are often driven by the need to remain competitive, attract a broader range of tenants at a more competitive price point, and comply with evolving sustainability mandates. They seek to unlock hidden value in undervalued assets.

Trophy Buildings: While also driven by sustainability, their retrofits are often aimed at maintaining their premium status, justifying higher face rents, and leveraging their built-in value for talent retention and subleasing advantages. The "flight to quality" often means tenants are willing to pay a premium for these assets.

Aesthetic vs. Systemic Focus:

Non-Trophy Buildings: Can incorporate significant cost-effective aesthetic upgrades to improve the tenant experience and market perception.

Trophy Buildings: While aesthetics are paramount, the retrofit efforts are heavily concentrated on high-performance systems and structural integrity to uphold their luxury and efficiency standards.

Navigating the Complexities: Risks, Pitfalls, and Robust Mitigation Strategies

This section will candidly address the challenges inherent in middle-market retrofits and provide actionable strategies for mitigating these risks, demonstrating a nuanced understanding of the subject.

Identifying Common Challenges in Middle-Market Retrofits

Retrofitting older office buildings, particularly those in the middle-market segment, presents a unique set of challenges that must be thoroughly understood and proactively managed.

High Initial Capital Expenditure & Budget Constraints: The upfront costs associated with comprehensive retrofits can be substantial, and unforeseen expenditures can significantly undermine project viability.8 For smaller businesses or organizations with tight budgets, a top-to-bottom building transformation may not be immediately feasible.

Compatibility Issues with Outdated Infrastructure: Older buildings often possess outdated foundational systems, including electrical wiring, plumbing, and HVAC components, that may be incompatible with modern MEP (Mechanical, Electrical, and Plumbing) systems. Many still rely on outdated gas-fired boilers that are not compatible with newer, more efficient alternatives.23 This incompatibility often necessitates customized, rather than off-the-shelf, solutions, leading to more complex and costly installations.

Integration Complexities and System Interoperability: Modern retrofits frequently involve integrating diverse automation technologies from various manufacturers. Ensuring these disparate systems communicate and work together seamlessly can be complex, potentially leading to inefficiencies or system failures if not managed expertly.

Limited Space for Equipment and Ductwork: Older buildings often have cramped spaces, restricted ceiling heights, and structural elements like columns or load-bearing walls that make it difficult to install or upgrade modern MEP systems, particularly bulky HVAC equipment and extensive ductwork.

Disruption to Ongoing Operations and Tenant Relations: Most retrofit strategies necessitate either vacant possession or proactive management of existing tenants.8 The retrofitting process can cause significant inconvenience, leading to days, weeks, or even months of disruption, which can result in revenue loss for tenants and generate complaints.

The "Knowledge and Expertise Gap": The terminology and techniques involved in modern retrofitting are often unfamiliar to many property owners and even some contractors. There is a strong business case for specialized expert services, but a shortage of trained professionals with a proven track record in retrofitting can slow project progress and increase costs.18 A lack of competency can lead to poorly designed and installed measures, resulting in unintended negative consequences such as damp and mold due to inadequate ventilation after insulation upgrades.18

Analytical Pitfalls:

Short Payback Period Mandates: A common fallacy involves financial decision-makers imposing arbitrary, very short payback periods (e.g., 2 years) for projects. This can lead to a focus on single, isolated measures, overlooking the compounding returns and long-term asset value derived from a holistic, integrated, and longer-term approach to retrofitting the entire building system.30

Isolated Project Analysis: Analyzing a single retrofit measure in isolation, rather than considering the building as a complex organic system with interdependent components, can lead to sub-optimal outcomes and ultimately diminish asset value. A comprehensive, long-term view (at least 10-15 years) of the total system is crucial.30

Incentive-Driven Distortions: While incentives can be beneficial, pursuing retrofits solely based on their availability, without a prior, proper financial analysis of the total system's benefits, can lead to inefficient or misaligned choices. The core financial viability should be established independent of incentives.30

The Spreadsheet Trap: Spreadsheets, while powerful, can make it easy to embed flawed assumptions or over-simplifications, leading to professional-looking but fundamentally flawed financial analyses that destroy asset value.30

Hidden Costs and Regulatory Complexity: Retrofits can incur hidden costs, such as Value Added Tax (VAT) in some regions (e.g., 20% in the UK), which does not apply to new construction, creating a disincentive.18 Additionally, complex building requirements, including new biodiversity net gain requirements and building safety regulation gateway delays, can add to project complexity and costs.8

Occupied Building Challenges: Carrying out intrusive surveys of existing structures and fabric can be difficult, or even impossible, in occupied buildings until the project is underway.26 The presence of asbestos in buildings constructed before 2000 is a significant risk that may require specialist surveys and testing, often only feasible once the project has begun.26

The challenges in retrofitting are multifaceted, spanning technical, financial, human, and regulatory domains. The "knowledge gap" and "analytical pitfalls" are particularly insidious, as they can undermine even well-intentioned projects. Acknowledging these complexities is crucial for realistic planning and successful execution.

Strategic Mitigation: Overcoming Hurdles for Project Success

Overcoming the inherent challenges in middle-market office retrofits requires a strategic, proactive, and multidisciplinary approach.

Comprehensive Building Assessment: Before initiating any commercial HVAC retrofit, a thorough understanding of the existing systems and building conditions is essential.33 This involves conducting a detailed site survey and equipment audit, inspecting ductwork and zoning, and evaluating controls, air balance, and integration. A well-documented assessment provides the necessary data to recommend targeted retrofits, ensure accurate budgeting, and avoid scope creep. This diagnostic phase identifies "low-hanging fruit" and prevents misallocation of resources, ensuring investments target the most impactful areas for return on investment.

Expert Engagement and Collaboration: Enlisting the expertise of experienced commercial renovation services, architects, and MEP engineers with a proven track record in retrofitting is critical. These professionals can design efficient solutions that maximize available space, explore alternative routing options, and utilize modular or prefabricated systems to address structural constraints. It is crucial to avoid choosing the lowest bid without assessing the contractor's specialized knowledge and experience in working around sensitive, live operations. Appointing an approved retrofit coordinator can oversee the entire project from inception to completion, ensuring competency and adherence to standards.26

Holistic, Long-Term Financial Analysis: A thorough cost-benefit analysis should be conducted, utilizing metrics such as Net Present Value (NPV), Internal Rate of Return (IRR), and Simple Payback Period (SPP). This analysis must consider the building as a complex organic system, taking a long-term view (at least 10-15 years) to capture compounding returns and the overall increase in asset value.30 It is important to analyze the core project's viability independently before factoring in incentives to avoid distorting financial decisions.30

Phased Scheduling and Minimizing Disruption: To minimize disruptions to ongoing operations, projects should be divided into manageable phases. A zone-by-zone approach allows work to be completed in isolated sections while other areas remain functional.33 Noisy or invasive tasks should be scheduled during off-hours, nights, weekends, or tenant changeovers. Utilizing temporary storage solutions for excess furniture, equipment, or documents can help keep both locations organized during transition.34

Clear Communication with Stakeholders: Transparent and consistent communication is essential to reduce confusion and frustration among employees, tenants, clients, and vendors. This includes sending advance notifications, move timelines, and instructions. Assigning internal move coordinators or a single point of contact can streamline communication and address concerns promptly.

Managing Unforeseen Expenditures: A contingency fund should always be incorporated into the budget to account for unexpected issues that commonly arise in older buildings. Prioritizing upgrades based on their return on investment and immediate needs can help manage costs effectively.

Code Compliance and Permitting: Work closely with regulatory authorities and MEP professionals who are experts in code compliance to ensure that retrofit designs meet all current building codes, energy efficiency standards (e.g., ASHRAE 90.1, Local Law 97), water conservation, fire safety, and electrical systems regulations. Account for potential asbestos remediation if the building was constructed before 2000.26

Structural Considerations: For buildings with structural constraints, engaging experienced MEP engineers is crucial for designing efficient solutions. This might involve utilizing compact equipment, exploring alternative duct routing options, or considering modular or prefabricated systems that can be assembled on-site to work within existing space limitations without sacrificing structural integrity.

The success of a retrofit hinges less on overcoming individual problems as they arise and more on a robust, multidisciplinary planning phase that anticipates and preemptively addresses potential issues. Proactive planning is the ultimate risk mitigator.

Table 2: Common Retrofit Challenges and Mitigation Strategies

The Strategic Blueprint: Key Steps for Successful, Budget-Conscious Retrofits

This comprehensive section provides a step-by-step guide for planning, implementing, and maintaining middle-market office retrofits, with a strong emphasis on achieving success within a modest budget.

Phase 1: Comprehensive Assessment and Strategic Planning

The initial phase lays the critical groundwork for a successful retrofit, emphasizing data-driven decision-making and meticulous planning.

Conducting a Detailed Energy Audit and Building Condition Analysis: The foundational role of data in strategic decision-making cannot be overstated. Before considering replacing existing equipment with new, higher-efficiency alternatives, it is essential to determine if the current systems are operating at optimal levels.17 This can be accomplished by performing a comprehensive energy audit, which should ideally be an ASHRAE Level 1, 2, or 3 audit to reveal inefficiencies in lighting, HVAC, and building envelope systems, as well as opportunities for load reduction and underutilized automation.

A review of utility bills from the last two years is crucial to determine if consumption, not just cost, has risen.17 The building envelope should be thoroughly examined for leaky windows, gaps around vents and pipe penetrations, and moisture intrusion. Upgrading heating and air-conditioning systems without addressing problems with the building envelope will result in suboptimal performance.17

Specialized methods like ASTM E1827 (Standard Test Methods for Determining Airtightness of Buildings Using an Orifice Blower Door) and ASTM E779 (Standard Test Method for Determining Air Leakage Rate by Fan Pressurization) can be employed to determine the airtightness of the building envelope.17

A comprehensive inventory of existing HVAC components, including air handlers, chillers, rooftop units, and ducting, should be performed to identify units nearing end-of-life or with performance issues, alongside a review of maintenance records for recurring repairs or energy spikes.33 Controls, air balance, and system integration should also be evaluated.33 Additionally, the building's water systems should be audited, as leaking and inefficient systems waste water and consume energy by needlessly running pumps.17 This diagnostic phase ensures that investments target the most impactful areas for return on investment.

Prioritizing High-Impact, Low-Cost Opportunities ("Low-Hanging Fruit"): For projects operating with modest budgets, identifying and implementing "low-hanging fruit" is a crucial strategy. These are modifications that are low-cost, easy to implement, and offer good value for the money and effort invested.13 Examples include sealing with caulking or spray foam, adding insulation, and upgrading lighting systems.13 This approach allows for immediate, cost-effective improvements that generate savings, which can then be reinvested to fund subsequent, larger upgrades.12 This iterative strategy is key to financial viability and building momentum for the project.

Developing a Robust Cost-Benefit Analysis and Contingency Plan: A rigorous financial plan is paramount for any retrofit, especially with budget constraints. This involves estimating the initial investment costs (materials, labor, equipment, permitting, design) and ongoing maintenance expenses, alongside the potential benefits such as energy savings, increased property value, and improved tenant retention.15 It is essential to evaluate potential risks and uncertainties associated with the retrofit.15

Key financial metrics such as Net Present Value (NPV), Internal Rate of Return (IRR), and Simple Payback Period (SPP) should be calculated to determine project feasibility and prioritize investments.15 Considering multiple scenarios and performing sensitivity analyses can provide a more robust understanding of potential outcomes.15 Crucially, a contingency fund must be incorporated into the budget to account for unforeseen expenses, which are inevitable in custom construction and retrofits of older buildings. Avoiding the "spreadsheet trap" and "isolated analysis" by taking a holistic, long-term view (10-15 years) ensures that investments are truly value-adding and sustainable, capturing compounding returns from interconnected systems.30

Assembling Your Expert Team: The "expertise gap" in retrofitting is a significant risk that can lead to project failure or suboptimal outcomes. Therefore, investing in the right team is critical. Property owners and managers should enlist experienced commercial renovation architects, MEP engineers, and contractors who possess a proven track record in retrofitting and navigating complex code compliance. It is vital to ensure the competency of installers and avoid simply choosing the lowest bid without thoroughly assessing their specialized knowledge and experience, particularly when working around sensitive, live operations. Appointing a dedicated retrofit coordinator can provide comprehensive project oversight, ensuring adherence to standards and effective communication between all stakeholders.26

Phase 2: Smart Implementation with Modest Budgets

This phase focuses on the practical execution of retrofit measures, prioritizing cost-effectiveness and minimizing disruption while maximizing impact.

Cost-Effective Aesthetic and Functional Upgrades: Many impactful aesthetic and functional improvements can be achieved with modest budgets, significantly enhancing tenant comfort and perception without major capital outlay.

Paint and Decor: A fresh coat of paint, especially in bright or water tones, is one of the least expensive ways to refresh an office space and create a pleasant ambiance. Adding wall art or decals can further personalize the workspace.

Decluttering and Reorganization: A clean and clutter-free office space fosters a positive environment. This involves removing worn-out furniture and appliances, and getting rid of anything unused to create more room.

Repurposing Existing Furniture: Instead of buying new furniture, existing pieces can be refinished or reupholstered to match an updated design theme, or old desks and chairs can be repainted for a fresh look.

Creating an Open Concept: Knocking down unnecessary walls or partitions can foster collaboration and create the illusion of more space, saving on construction costs while enhancing aesthetics. Switching from cubicles to an open concept can allow teams more space to brainstorm and communicate effectively.

Biophilic Design (Plants): Incorporating low-maintenance indoor plants like succulents or snake plants is an affordable and aesthetically pleasing way to breathe life into a workspace. Plants can boost productivity, reduce stress, improve air quality, and even counteract "sick building syndrome".

Quirky Accents: Inviting employees to contribute to a theme and hunt for unique decor at garage sales or thrift stores can give the office personality and foster engagement.

These "soft" retrofits can significantly enhance tenant comfort and perception at minimal cost, contributing directly to tenant satisfaction and retention. This is a smart initial investment for any middle-market retrofit.

Optimizing Mechanical, Electrical, and Plumbing (MEP) Systems: MEP systems are major energy consumers (HVAC alone accounts for 35% of commercial building energy use 28), making their optimization crucial for economic justification.

Energy-Efficient Lighting: Upgrading to Light Emitting Diode (LED) lighting with motion and daylight sensors optimizes energy use based on occupancy and natural light levels, significantly reducing energy consumption and operational costs. This also reduces heat load, thereby decreasing HVAC cooling demand.33

Advanced HVAC Optimization: Integrating modern Building Management Systems (BMS) allows for real-time monitoring, predictive maintenance, and automated adjustments, enhancing efficiency and occupant comfort. Installing Variable Frequency Drives (VFDs) allows motors to adjust their speed based on demand, significantly reducing energy consumption and wear and tear. Retro-commissioning systematically optimizes existing HVAC systems to perform as intended, offering a cost-effective approach with high return on investment.10 Improving air distribution through advanced air filtration systems, adjusting ductwork, and sealing leaks can further enhance efficiency and indoor air quality. Upgrading to eco-friendly refrigerants ensures compliance with regulations and enhances system performance. Investigating natural ventilation and fresh air intake can also reduce heating and cooling loads.17

Water Efficiency Measures: Monitoring and optimizing cooling tower operations (e.g., blowdown, system leaks, and drift) can lead to substantial water savings, as cooling towers are large consumers of water in commercial buildings.10 Installing low-flow faucets with sensors and automatic shut-offs also contributes to water conservation.13

Sub-metering: Installing sub-metering delivers granular, real-time insights into energy and water consumption at a tenant or equipment level, going beyond the main utility meter. This provides crucial data for managing consumption and identifying further efficiency opportunities.

The focus on "smart" technologies allows for phased implementation and real-time monitoring, which is ideal for modest budgets as it ensures efficiency and helps verify savings. Financial prudence in procurement is also key: using standard products, sourcing locally, and avoiding over-specification can reduce costs.2

Enhancing the Building Envelope: A well-performing building envelope is fundamental to energy efficiency. Upgrading heating and air-conditioning systems without addressing problems with the building envelope will result in less than optimum performance of those systems.17

Adding insulation where it makes economic sense can significantly reduce energy consumption.13

Improving air tightness by examining the building envelope and looking for leaky windows, gaps around vents and pipe penetrations, and moisture intrusion is crucial.16

Replacing existing windows with high-performance windows appropriate for the climate and exposure can greatly reduce heat loss or gain.13

Considering cool roofs or green roofs can be cost-effective ways to reduce the heat island effect and stormwater runoff.17

Investing in the building envelope is a critical, long-term investment that maximizes the effectiveness of other energy-saving measures.

Table 3: Cost-Effective Retrofit Measures for Modest Budgets

Table 3: Cost-Effective Retrofit Measures for Modest Budgets

Minimizing Disruption and Managing Occupant Relations: Operational disruption is a major challenge in retrofitting occupied buildings. A well-planned, phased approach with transparent communication is essential for maintaining business continuity and tenant satisfaction, which directly impacts lease retention.

Phased Scheduling: Implement retrofits in manageable phases (e.g., light, minor, major, deep retrofits). A zone-by-zone approach allows work to be completed in isolated sections, ensuring other areas of the building can continue to function as usual.33

Off-Hours Execution: Schedule noisy or invasive tasks during nights, weekends, or other low-traffic periods to minimize disruption to daily business operations.

Temporary Solutions: Provide temporary cooling or heating, or arrange for alternative workspaces if significant system downtime is unavoidable.33 Utilizing temporary storage solutions for excess furniture, equipment, or documents can help keep both locations organized during the transition.34

Isolation of Work Areas: Implement strict dust and noise control measures, sealed barriers, and infection control protocols (especially critical for healthcare retrofits) to protect occupants and maintain a safe environment.33

Clear Communication: Proactive and clear communication with all stakeholders—employees, tenants, clients, and vendors—is paramount. This includes sending out advance notifications, detailed move timelines with key dates and instructions, and regular progress check-ins. Assigning internal move coordinators or a single point of contact can streamline communication and address any concerns promptly.

Phase 3: Post-Retrofit Performance and Continuous Optimization

Retrofitting is not a one-time event but an ongoing process of optimization. This final phase focuses on sustaining the benefits and adapting to future needs.

Monitoring and Verification of Savings: The investment in retrofits needs to be justified by actual, measurable savings. Therefore, continuous monitoring and verification are crucial to ensure sustained performance and verify the promised return on investment. Regularly measure the building's performance against design specifications and established benchmarks.16 Tools like ENERGY STAR Portfolio Manager can be effectively used for benchmarking and tracking investments once implemented.13 Continuously evaluating energy usage and savings data allows for performance optimization and identification of new opportunities for improvement.16

Ongoing Maintenance and Re-commissioning: A building's performance is dynamic, and systems inevitably decay over time.11 Without ongoing maintenance and periodic re-commissioning, performance will degrade, eroding the benefits of the retrofit. Maintain post-retrofit performance to maximize return on investment.12 It is recommended to consider re-commissioning every 3-5 years, as sensors and controls inevitably decay, heating coils clog, and new technologies come online that offer cost-effective hardware and software upgrades.11 Incorporating sustainable operations and maintenance practices, such as switching to green cleaning products and methods, further enhances the building's long-term environmental and operational performance.17

Adapting to Evolving Market and Tenant Needs: The office market is constantly evolving, with new trends in space utilization and work styles emerging regularly.26 A successful long-term strategy involves continuous adaptation and refinement of the building's offerings to maintain competitiveness and tenant appeal. Continuously identify new opportunities for improvement and adjust project scope and implementation plans as needed.16 Staying abreast of emerging space trends, such as open floor plans, high-end amenities, and flexible space requirements, is crucial to ensure the middle-market building remains relevant and attractive to future tenants.26 This proactive approach ensures the asset's long-term value and marketability.

Building Microgrids: Microgrids are localized energy systems that can operate independently or connected to the main grid, offering enhanced resilience and energy management. Commercial microgrids can reduce energy expenses by 20-30% and provide critical resilience against power disruptions.36 They represent a strategic investment in operational efficiency, sustainability, and long-term cost control.36

For example, one implementation saw a 35% reduction in energy consumption, a 42% decrease in peak demand charges, and annual utility cost savings of $875,000.34 Typical payback periods range from 5-7 years, with some systems achieving payback in as little as 3 years, and average energy cost savings of 25-35% annually.36

While initial investment costs can range from $1-6 million per MW depending on complexity, various financial incentives, including federal tax credits (up to 30%), state grants, rebates, and utility programs, can substantially reduce these costs.36 Beyond direct savings, microgrids enhance property value (typically 5-10% increase), reduce maintenance costs, and offer business continuity benefits during outages.36 This technology makes retrofits more financially attractive and future-proof, especially for buildings seeking greater energy independence and resilience.

Conclusion: The Future of Value Creation in Middle-Market Office Real Estate

The analysis presented in this report unequivocally demonstrates that office retrofits do not need to start with an iconic structure or premier location. On the contrary, middle-market buildings—ranging from well-positioned Class A assets to functional Class B properties and even Class C "fixer-uppers"—represent a vast and increasingly attractive frontier for strategic value creation. The argument for retrofitting non-trophy buildings is not merely feasible but compelling, driven by a confluence of economic imperatives, regulatory mandates, and evolving tenant expectations.

The market is undergoing a fundamental shift where "quality" is increasingly defined by a holistic tenant experience, operational efficiency, and sustainability credentials, rather than solely by a prestigious address. While trophy buildings command high face rents, the generous tenant concessions offered in non-trophy Class A and B buildings significantly narrow the effective rent gap, positioning retrofitted middle-market assets as highly competitive and value-driven alternatives. This creates a powerful arbitrage opportunity for investors.

Furthermore, regulatory pressures, such as Minimum Energy Efficient Standards (MEES) requiring improved EPC ratings by 2027 and 2030, are transforming retrofits from a discretionary choice into a strategic necessity for asset preservation and future market viability. Proactive retrofitting mitigates the significant "costs of inaction," including energy inefficiency, reduced property value, and tenant churn.

Quantifiable benefits, including substantial energy cost savings (up to 60% for deep retrofits), net operating income increases (2.4-5.6%), and property value appreciation ($5-$11 per square foot), underscore the robust economic justification. These direct financial gains are compounded by "soft benefits" such as improved tenant comfort, increased lease lengths, and enhanced ESG alignment, all contributing to long-term asset resilience.

Real-world case studies, from the energy efficiency gains of the century-old Self-Help building to the strategic repositioning of the DWS Group's complex into a medical office, illustrate the diverse pathways to value creation in the middle market. These examples confirm that significant transformations are achievable across various building types and ages, often without requiring massive budgets.

Navigating the complexities of retrofitting, including high initial costs, compatibility issues with outdated infrastructure, and potential disruption to operations, requires a strategic approach. However, these challenges are surmountable through comprehensive building assessments, engagement of expert teams, holistic financial analysis, phased implementation, clear communication, and robust contingency planning.

Leveraging available utility incentives, government grants, and ESCO partnerships can significantly mitigate upfront capital outlays. The integration of new technologies like building microgrids, fault-managed power, and battery-powered agile furniture further reduces retrofit costs and expands the range of buildings that can be viably considered for upgrades, making modernization more accessible and impactful.

The "retrofit revolution" in the middle market is not just a trend but a necessary evolution for a significant portion of the commercial real estate stock. It is about making existing buildings future-ready in terms of sustainability, functionality, and economic performance.

Final Recommendations:

Prioritize Comprehensive Assessment: Initiate every retrofit project with a detailed energy audit and building condition analysis to identify specific inefficiencies and high-impact opportunities. This data-driven approach is foundational for informed decision-making and budget allocation.

Embrace a Phased Approach: For modest budgets, adopt an incremental strategy, starting with "low-hanging fruit" measures that offer rapid payback. Reinvest initial savings to fund subsequent, more substantial upgrades, building momentum and demonstrating continuous value.

Leverage Financial Levers: Actively research and pursue utility incentives, government grants, and energy efficiency loans. Explore partnerships with Energy Service Companies (ESCOs) to access turnkey solutions that can include financing, installation, and maintenance, reducing the upfront burden.

Invest in Expert Teams: Engage experienced architects, MEP engineers, and contractors with a proven track record in retrofitting and navigating regulatory complexities. The initial investment in expertise mitigates far greater risks of project failure, cost overruns, and suboptimal performance.

Maintain Transparent Communication: Implement a robust communication plan with all stakeholders—tenants, employees, and vendors—throughout the retrofit process. Clear, proactive updates on schedules, potential disruptions, and benefits are crucial for maintaining business continuity and fostering positive relationships.

Commit to Continuous Optimization: Recognize that a retrofit is not a one-time event but an ongoing process. Implement continuous monitoring of building performance, schedule regular maintenance, and plan for periodic re-commissioning (every 3-5 years) to ensure sustained efficiency, maximize long-term ROI, and adapt to evolving market and tenant needs.

Embrace Emerging Technologies: Actively explore and integrate new technologies such as building microgrids, fault-managed power systems, and battery-powered agile furniture. These innovations can significantly reduce retrofit costs, simplify complex upgrades, and expand the range of buildings that can be viably transformed, enhancing overall project feasibility and long-term value.

By embracing these strategies, property owners and investors can unlock the hidden value within middle-market office buildings, transforming them into resilient, high-performing assets that meet the demands of today's market and contribute meaningfully to a sustainable future. The evidence is clear: the greenest building is indeed the one already built, and its retrofit holds immense potential.

Real estate classifications like 'mid-market' and 'non-trophy' are dynamic and highly dependent on specific local market conditions, requiring granular analysis for accurate assessment.

About the author:

Bob Kroon is a recognized thought leader and innovator with over four decades of experience in the electro-mechanical and furniture industries. As the CEO and founder of August Berres, he envisions overcoming the limitations of traditional building power by enabling the Agile Workplace through a smart power ecosystem.

Bob passionately advocates for technologies such as building microgrids, fault-managed power (FMP), and battery-powered Agile Furniture, which are transforming the design and utilization of commercial spaces. Under his leadership, a suite of innovative solutions has been brought to market, including Respond!, Juce, CampFire, and Wallies. These products empower building owners, architects, and facility managers to retrofit buildings for today’s dynamic work environment.

Battery-powered endpoints reduce the complexity and cost of any retrofit.

Contact us now for your next project.

Works cited

Branded Office Buildings in NYC: Are They Worth the Price Tag?, accessed August 11, 2025, https://www.metro-manhattan.com/blog/do-branded-office-buildings-in-nyc-really-justify-their-price-tag/

www.hellodata.ai, accessed August 11, 2025, https://www.hellodata.ai/help-articles/what-does-mid-market-mean-in-real-estate#:~:text=For%20commercial%20real%20estate%2C%20mid,good%20quality%20and%20investment%20potential.

What does mid-market mean in real estate? - HelloData, accessed August 11, 2025, https://www.hellodata.ai/help-articles/what-does-mid-market-mean-in-real-estate

Trophy vs. Class A Office in the North & Northwest Suburban Markets: Where Are Tenants Going? - Hiffman, accessed August 11, 2025, https://hiffman.com/north-northwest-trophy-class-a-shane-murphy/

The NYC Office Building Classification Explained (Trophy vs. Class A vs. Class B vs. Class C) - Hedge Fund Office Spaces, accessed August 11, 2025, https://www.hedgefundspaces.com/nyc-office-building-classification-explained-trophy-vs-class-a-vs-class-b-vs-class-c/

Class A, Class B, and Class C Offices: 3 Types of Commercial Buildings - New Jersey Real Estate Network, accessed August 11, 2025, https://www.newjerseyrealestatenetwork.com/blog/office-building-classes/

The 3 Classes of Office Buildings: Class A, Class B, and Class C - VTS, accessed August 11, 2025, https://www.vts.com/blog/the-3-office-buildings-classes-what-do-they-really-mean

Offices: repurpose or retrofit – where are we today? | Insights - Mayer Brown, accessed August 11, 2025, https://www.mayerbrown.com/en/insights/publications/2025/03/offices-repurpose-or-retrofit-where-are-we-today

Building Retrofit and Energy Conservation/Efficiency Review: A Techno-Environ-Economic Assessment of Heat Pump System Retrofit in Housing Stock - MDPI, accessed August 11, 2025, https://www.mdpi.com/2071-1050/13/2/983

Top 10 Retrofit Methods for Sustainable Buildings - Attune IoT, accessed August 11, 2025, https://www.attuneiot.com/resources/top-retrofit-methods-sustainable-buildings

Retro Commissioning & High ROI for Commercial Buildings - PRIDE Industries, accessed August 11, 2025, https://www.prideindustries.com/our-stories/retro-commissioning-high-roi

Major Energy Retrofit Guidelines for Commercial and Institutional Buildings: Principles - Natural Resources Canada, accessed August 11, 2025, https://natural-resources.canada.ca/sites/nrcan/files/oee/buildings/pdf/RetrofitGuidelines-e.pdf

Retrofitting - Natural Resources Canada, accessed August 11, 2025, https://natural-resources.canada.ca/energy-efficiency/building-energy-efficiency/retrofitting

Unlocking Hidden Value in Class B/C Office Buildings - RMI, accessed August 11, 2025, https://rmi.org/insight/unlocking-hidden-value-in-class-bc-office-buildings/

The Cost-Benefit Analysis of Retrofitting - Number Analytics, accessed August 11, 2025, https://www.numberanalytics.com/blog/cost-benefit-analysis-retrofitting-rental-property-maintenance

Maximizing ROI with Retrofits and Upgrades - Number Analytics, accessed August 11, 2025, https://www.numberanalytics.com/blog/maximizing-roi-retrofits-upgrades-building-systems

Retrofitting Existing Buildings to Improve Sustainability and Energy Performance | WBDG, accessed August 11, 2025, https://www.wbdg.org/resources/retrofitting-existing-buildings-improve-sustainability-and-energy-performance

What are the Challenges of Retrofitting? | CityChangers.org, accessed August 11, 2025, https://citychangers.org/challenges-retrofitting/

Creating a Budget for Your Deep Retrofit Project - House2Home, accessed August 11, 2025, https://house2home.ie/creating-a-budget-for-your-deep-retrofit-project/

The Cost of Insufficient CRE Due Diligence - AEI Consultants, accessed August 11, 2025, https://aeiconsultants.com/the-cost-of-insufficient-cre-due-diligence/

Increasing the Market Value of Buildings Through Energy Retrofitting: A Comparison of Actual Retrofit Costs and Perceived Values - MDPI, accessed August 11, 2025, https://www.mdpi.com/2075-5309/15/3/376

How to finance the retrofit of municipal buildings - C40 Knowledge Hub, accessed August 11, 2025, https://www.c40knowledgehub.org/s/article/How-to-finance-the-retrofit-of-municipal-buildings

Challenges & Solutions in Retrofitting MEP System in Existing Building - NY Engineers, accessed August 11, 2025, https://www.ny-engineers.com/blog/overcoming-the-challenges-in-retrofitting-mep-systems-in-existing-buildings

What are the safety risks with retrofitting?, accessed August 11, 2025, https://projectsafetyjournal.com/is-retrofitting-all-its-cracked-up-to-be/

Valuing Energy Efficiency in Mixed-Use Office Spaces - IMT, accessed August 11, 2025, https://imt.org/resources/valuing-energy-efficiency-in-mixed-use-office-spaces/

Repositioning Office Buildings from Class B to A - Margulies Perruzzi, accessed August 11, 2025, https://mparchitectsboston.com/repositioning-office-buildings-from-class-b-to-a/

Developing a Smart Retrofitting Decision-Making Model for Office Buildings: A Case Study - Purdue e-Pubs, accessed August 11, 2025, https://docs.lib.purdue.edu/cgi/viewcontent.cgi?article=1039&context=cib-conferences

Retrofitting buildings for energy efficiency - ABM Perspectives, accessed August 11, 2025, https://www.abm.com/perspectives/retrofitting-buildings-for-efficiency-strategies-for-office-healthcare-schools-and-more

Key Considerations for Commercial Retrofit - UKGBC, accessed August 11, 2025, https://ukgbc.org/wp-content/uploads/2022/05/Commercial-Retrofit-Report.pdf

Proper Analysis of Building Retrofits - Energy Central, accessed August 11, 2025, https://www.energycentral.com/customer-engagement-experience/post/proper-analysis-of-building-retrofits-tJwPCI1tnCSfTTM

August Berres: Battery Power for Agile Workplaces | Building Retrofits, accessed August 11, 2025, https://www.augustberres.com/

Challenges and Solutions in Retrofitting MEP Systems in Existing Structures, accessed August 11, 2025, https://www.natlmep.com/challenges-and-solutions-in-retrofitting-mep-systems-in-existing-structures/

Retrofit Planning Guide: Commercial HVAC Retrofits Without Downtime - HMH Contractors, accessed August 11, 2025, https://hmhmechanical.com/how-to-plan-a-retrofit-for-commercial-hvac-without-disrupting-operations/